- July 14, 2025

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The post Wall Street Piles Up Ethereum: ETH Price Warms Up for $4k Next appeared first on Coinpedia Fintech News

The demand for Ethereum (ETH) has gone up through the roof in recent times, led by Wall Street corporations. After more than a year trailing Bitcoin (BTC) in net cash inflows, on-chain data analysis shows that long-term investors have favored Ether.

Ethereum Records Renewed Demand for Long-term Investors

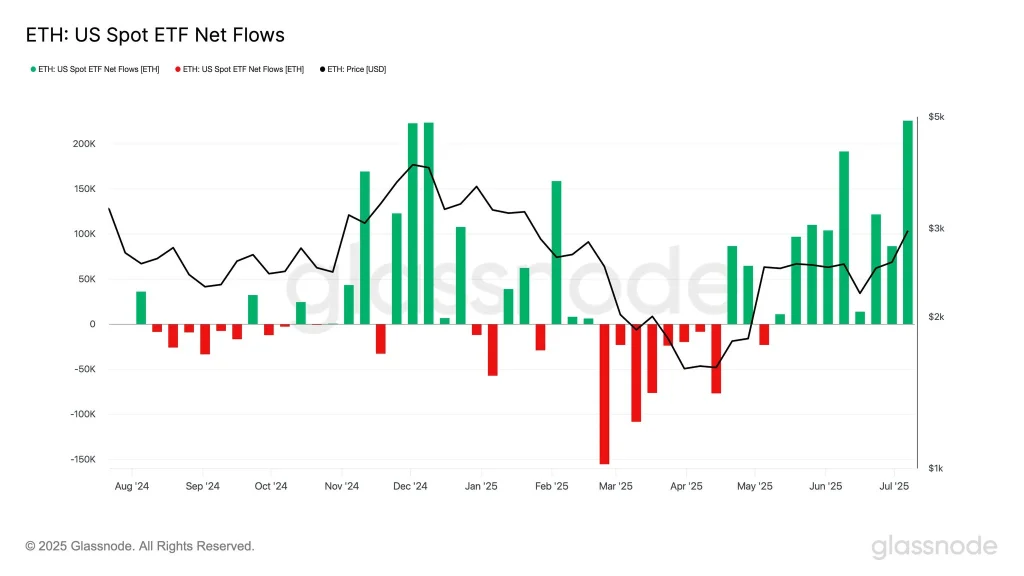

For instance, the U.S. spot Ether ETFs, led by BlackRock’s ETHA, recorded the highest weekly cash inflow, of about $908 million, since their inception. As a result, the U.S. spot Ether ETFs extended their multi-week streak of cash inflows, whereby the cohorts have recorded over $2.7 billion in net cash inflows for the past four months.

The demand for Ether by corporations has also skyrocketed in the recent past. For instance, BitMine, a publicly traded company, announced on Monday that its Ether holding has surpassed $500 million. After closing a $250 million private placement, BitMine increased its ETH bath to 163,142 coins.

”We are pleased that we added significantly to our ETH treasury just 3 days after closing our private placement,” Jonathan Bates, CEO of BitMine, noted. “Clearly Wall Street is getting ‘ETH-pilled.”

Midterm Targets for ETH Price

After consolidating in a choppy mode for the past two months, Eth price recently broke out beyond $3k for the first time since January 2025. The large-cap altcoin, with a fully diluted valuation of about $363 billion, has since signaled bullish sentiment.

From a technical analysis standpoint, Ether price is aiming for $3,400 next with the pathway towards $4k more clear. Furthermore, the weekly MACD indicator has flashed bullish sentiment after the MACD line recently crossed above the zero line amid increasing bullish histograms.