- January 4, 2026

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

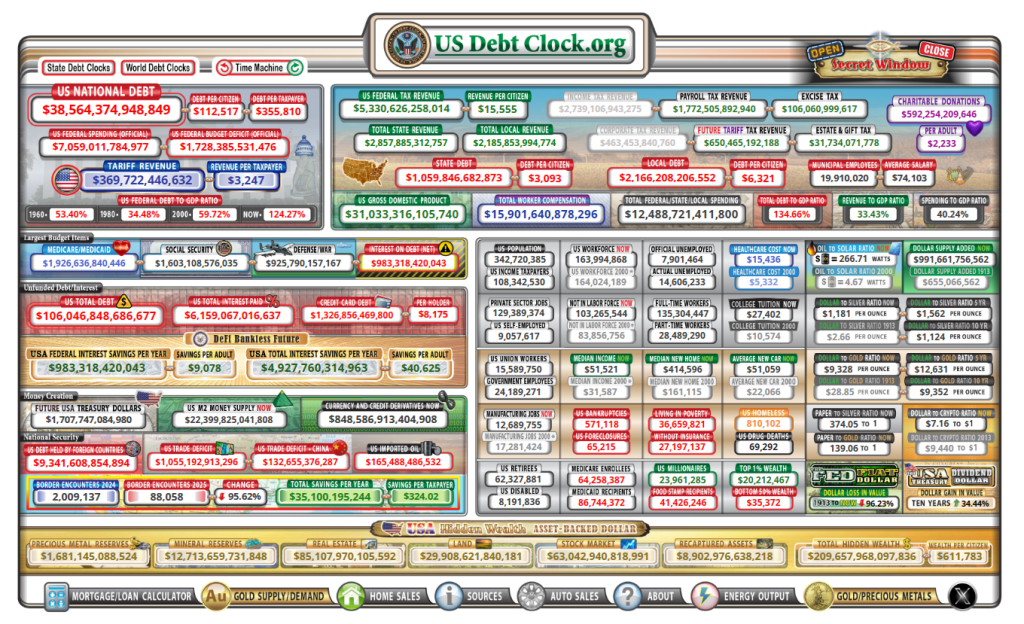

The US federal debt passed $38 trillion on January 3, 2026, according to Treasury tracking. That new milestone was reached as some in the cryptocurrency community observed Genesis Day, the anniversary of Bitcoin’s first block. Reports note the timing drew attention because it highlighted contrasts between public borrowing and Bitcoin’s fixed supply.

Debt Hits New High

According to Treasury figures, the gross federal debt climbed past $38 trillion on January 3. The rise has been sharp over the last two years, moving from about $34 trillion in early 2024 to roughly $36 trillion by late 2024, and then at $38.5 trillion in late 2025.

Analysts have calculated that the debt has been increasing by roughly $6 billion per day recently, a pace that pushes interest costs higher and narrows options for future budgets. Some of the increase comes from continuing budget shortfalls where spending outstrips revenue.

On 3 January 2009, the Bitcoin network launched with the mining of its first block, known as the Genesis Block.

Embedded in that block was a headline from @TheTimes newspaper:

“Chancellor on brink of second bailout for banks.”

The message permanently anchors Bitcoin’s origin… pic.twitter.com/hGozJOYd3I

— Bitcoin Policy UK (@bitcoinpolicyuk) January 3, 2026

Drivers Behind The Surge

According to market coverage, several factors are behind the jump: sustained annual deficits, increasing interest payments on existing debt, and large spending bills enacted in recent sessions of Congress.

Debt held by the public and amounts owed to federal trust funds together make up the headline figure. Economists warn that as the debt grows relative to the size of the economy, more taxpayer dollars will be needed just to service interest payments, which could crowd out other priorities.

Bitcoin Community Responds

On January 3, many Bitcoin supporters marked Genesis Day, a date they view as symbolic of financial change when Bitcoin’s first block was mined in 2009. Some users posted about the contrast between a national debt that keeps climbing and Bitcoin’s capped supply of 21 million coins.

Others used the anniversary to elevate broader questions about fiscal rules and money supply. The reactions were mixed; some view it as a warning, others saw it as a moment for commemoration.

Investors and commentators have weighed the implications. A portion of the market treats scarce assets like Bitcoin and gold as hedges against what they view as the risks of heavy borrowing.

At the same time, mainstream economists caution that running large and persistent deficits can raise borrowing costs and slow growth over the long run. Treasury officials monitor cash needs closely and sometimes change borrowing schedules to cover gaps between receipts and outlays.

Featured image from Unsplash, chart from TradingView