- January 20, 2026

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The post Ripple XRP Price Prediction 2026, 2027-2030: Will XRP Reach $5? appeared first on Coinpedia Fintech News

Story Highlights

- The Live Price Of XRP $ 1.95133573

- Predictions suggest XRP could reach $5.05 by the end of 2026.

- Long-term projections show XRP could hit $26.50 by 2030 and $526 by 2050.

XRP price currently stands at $2.99, with a market capitalization of $179.79 billion. Analysts and AI forecasts alike suggest that XRP could reach $5.05 by the end of 2025. Long-term XRP price predictions also place it as high as $26.50 by 2030, with an ultra-bullish target of $526 by 2050.

Ripple (XRP) remains one of the top five crypto assets in the world, gaining traction as institutional adoption ramps up and its prolonged legal battle approaches resolution. Since President Trump’s return to office, XRP has seen a resurgence in on-chain activity, investor sentiment, and even XRP ETF approved turned it into a bluechip asset.

In Q3 2025, XRP marked a new all-time high of $3.66,but in Q4 it fell extensively. Now soon Q4 will conclude and 2026 would begin. Now, making this as most idle time for XRP price prediction 2026-2030 to be in more focus. Read this to know in depth to what’s coming next in XRP.

XRP Price Today

| Cryptocurrency | XRP |

| Token | XRP |

| Price | $1.9513 |

| Market Cap | $ 118,620,720,950.97 |

| 24h Volume | $ 2,801,164,368.9222 |

| Circulating Supply | 60,789,498,738.00 |

| Total Supply | 99,985,727,631.00 |

| All-Time High | $ 3.8419 on 04 January 2018 |

| All-Time Low | $ 0.0028 on 07 July 2014 |

Table of contents

- Story Highlights

- Coinpedia’s XRP Price Prediction

- How Was the XRP Price In 2025?

- XRP Price Prediction 2026

- XRP Price Predictions for January 2026 by AI platforms

- XRP Onchain Outlook

- Ripple XRP Price Prediction 2026 – 2030

- Ripple (XRP) Price Projection 2031, 2032, 2033, 2040, 2050

- Market Analysis

- FAQs

Coinpedia’s XRP Price Prediction

In early 2026, XRP broke out of a falling wedge pattern and revisited the 200-day EMA. To confirm a bullish trend, it must exceed the $2.35 mark. Strong inflows from ETFs support a positive outlook; however, failing to break through these key levels could result in declines. The first quarter of 2026 is crucial for XRP’s future performance.

How Was the XRP Price In 2025?

The year 2025 clearly demonstrated that $2 was a strong support level for XRP price, with the price consistently trading near this mark despite attempts to push higher. Notably, the year also concluded with XRP successfully closing above $2, showcasing resilience amid macroeconomic uncertainties.

Analyzing XRP/USD in two distinct halves reveals a compelling narrative. The first half of 2025 saw a transition from decline to a period of consolidation, which persisted until the end of June. The second half ignited excitement with a rally that propelled the price to an all-time high of $3.66. However, after this peak, the price entered a narrow falling wedge pattern, illustrating constrained price movements. There were moments when it dipped to around $1.80 but swiftly rebounded above the $2 mark.

The persistent demand around $2 positioned XRP as a strong candidate for a rally. While 2025 presented its challenges, but it laid the groundwork for a significant surge ahead in 2026.

XRP Price Prediction 2026

The falling wedge pattern from Q4 2025 decisively broke in the early days of 2026, with XRP’s price even revisiting the 200-day EMA. Recently, it faced a decline to the upper border of the falling wedge, which has now established itself as a solid dynamic support level alongside $1.85 horizontal support zone.

In the short term, XRP is clearly on a trajectory heading towards $2.35, and if it successfully pushes beyond that, a retest of $2.62 is almost likely. Should this occur, we will see a significant reduction in hesitation as XRP gears up to challenge its all-time high (ATH) once again.

In fact, there is a strong potential for XRP/USD to soar by 50%, aiming for an ATH retest of $3.66 in Q1 2026.

On the flip side, if XRP/USD continues to adhere to its current downtrend, we could face a substantial decline that tests lower support levels and negatively impacts overall market sentiment. The first quarter of 2026 is poised to be critical for both investors and analysts, who need to closely monitor the market dynamics shaping XRP’s performance.

| Year | Potential Low | Potential Average | Potential High |

| 2026 | $1.75 | $3.45 | $5.05 |

XRP Price Predictions for January 2026 by AI platforms

| Platform | Low Price | Average Price | High Price |

| Claude | $3.00 – $3.15 | $3.50 – $4.00 | $7.50 – $8.20 |

| Blackbox | $2.50 | $3.50 | $5.00 |

| Gemini | $3.00 – $4.00 | $4.50 – $6.00 | $6.50 – $8.00+ |

XRP Onchain Outlook

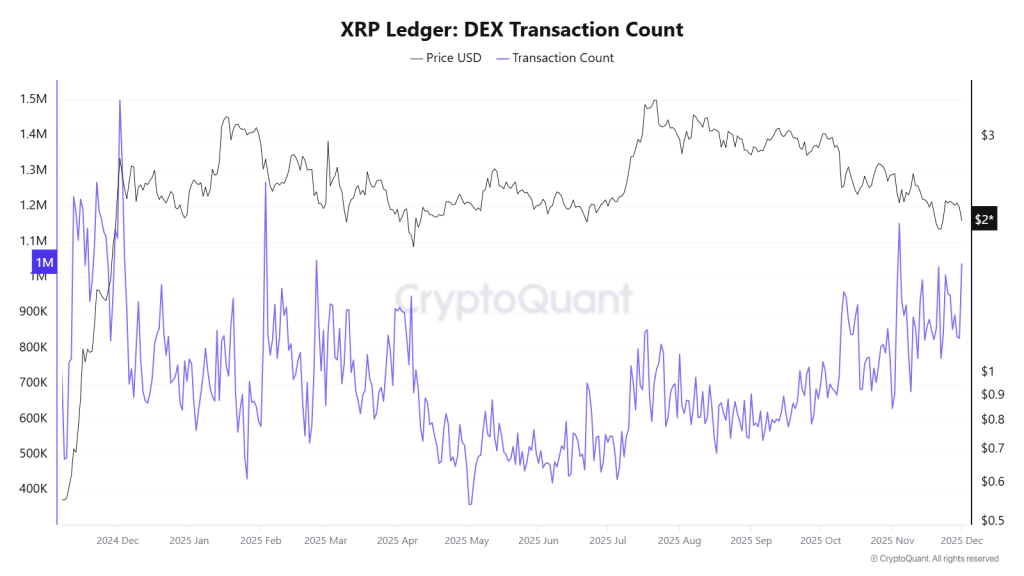

The XRP Ledger: DEX Transaction Count chart indicates a significant bullish divergence starting from May 2025. While the price is consolidating, the activity in decentralised exchanges (DEX) is increasing sharply.

The high transaction volume, which includes both orders placed and cancelled, shows that experienced traders are actively positioning themselves and adding liquidity in anticipation of a future price movement.

As a result, this on-chain metric suggests that the market is preparing for a powerful and sustainable rally in the XRP price ahead.

Also, the biggest fact right now in December is that altcoin liquidity is drying up. Projects securing new liquidity channels like ETFs have a better chance of long-term survival, and since November 14th, the XRP ETF has been seeing positive inflows consistently, despite what price action is, and so far, Cumulative Total Net Inflow has crossed $756 million, while total net assets are worth $723.05 million, by December 1st.

Ripple XRP Price Prediction 2026 – 2030

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| XRP Price Prediction 2026 | 5.50 | 6.25 | 8.50 |

| Ripple Price Prediction 2027 | 7.00 | 9.0 | 13.25 |

| XRP Price Prediction 2028 | 11.25 | 13.75 | 16.00 |

| XRP Price Prediction 2029 | 14.25 | 16.50 | 21.50 |

| XRP Price Prediction 2030 | 17.00 | 19.75 | 26.50 |

This table, based on historical movements, shows XRP price prediction 2030 to reach $26.50 based on compounding market cap each year. This table provides a framework for understanding the potential XRP price movements. Yet, the actual price will depend on a combination of market dynamics, investor behavior, and external factors influencing the cryptocurrency landscape.

Ripple (XRP) Price Projection 2031, 2032, 2033, 2040, 2050

Based on historic price sentiments and XRP’s rising popularity, here are the XRP future price projections beyond 2030, where Ripple price forecasts suggest that it has become more speculative. Therefore, assuming continued adoption and dominance, XRP may see aggressive valuations in the decades ahead.

| Year | Potential Low ($) | Potential Average ($) | Potential High ($) |

| 2031 | 25.00 | 29.50 | 35.25 |

| 2032 | 31.50 | 36.75 | 41.25 |

| 2033 | 35.75 | 42.25 | 47.75 |

| 2040 | 97.50 | 135.50 | 179.00 |

| 2050 | 219.25 | 331.50 | 526.00 |

A look at this table, highlights the XRP price prediction 2040 and XRP price prediction 2050 potential high ambitious targets but this reflect a transformative vision for XRP as a dominant global payment player.

Market Analysis

| Firm Name | 2025 | 2026 | 2030 |

| Changelly | $2.05 | $3.49 | $17.76 |

| Coincodex | $2.38 | $1.83 | $1.66 |

| Binance | $2.16 | $2.27 | $2.76 |

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

FAQs

XRP price predictions for 2026 range between $3.45 and $5.05, depending on ETF inflows, market sentiment, and sustained demand above key levels.

By 2030, XRP forecasts suggest a potential range of $17 to $26.50 if adoption grows and Ripple maintains its role in global payments.

Long-term projections estimate XRP could trade between $97 and $179 by 2040, assuming continued network usage and institutional integration.

XRP’s outlook for 2026 depends on ETF inflows, broader crypto sentiment, and its ability to hold key support levels above $2.