- December 29, 2025

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The post Top Reasons Why Ethereum Price Could Be Setting Up for a Strong Rally in 2026 appeared first on Coinpedia Fintech News

Ethereum price is quietly attracting more liquidity across derivatives, on-chain activity, and exchange flows, even as its price remains locked in a consolidation range. While ETH has struggled to produce a decisive breakout in recent weeks, underlying data suggests participation across the network is strengthening. This growing disconnect between improving fundamentals and muted price action is drawing close attention from traders, raising a key question: Is liquidity positioning ahead of a larger move, or simply building risk within the range?

Derivatives Positioning: Open Interest Continues to Climb

Data from CryptoQuant shows Ethereum open interest rising steadily toward the $19–20 billion range, approaching recent highs. Importantly, this increase has occurred without a corresponding price expansion. For traders, rising open interest in a sideways market often signals positioning rather than trend confirmation. It suggests expectations are building for a larger directional move while also increasing the risk of volatility once the price breaks out of its current structure.

Exchange Reserves: Signs of Supply Tightening

Ethereum exchange reserves have trended lower over the same period, indicating a reduction in readily available sell-side supply. While short-term fluctuations remain, the broader picture points toward ETH being moved off exchanges rather than prepared for immediate liquidation. Historically, declining exchange balances tend to support price stability during periods of consolidation, especially when combined with rising derivatives participation.

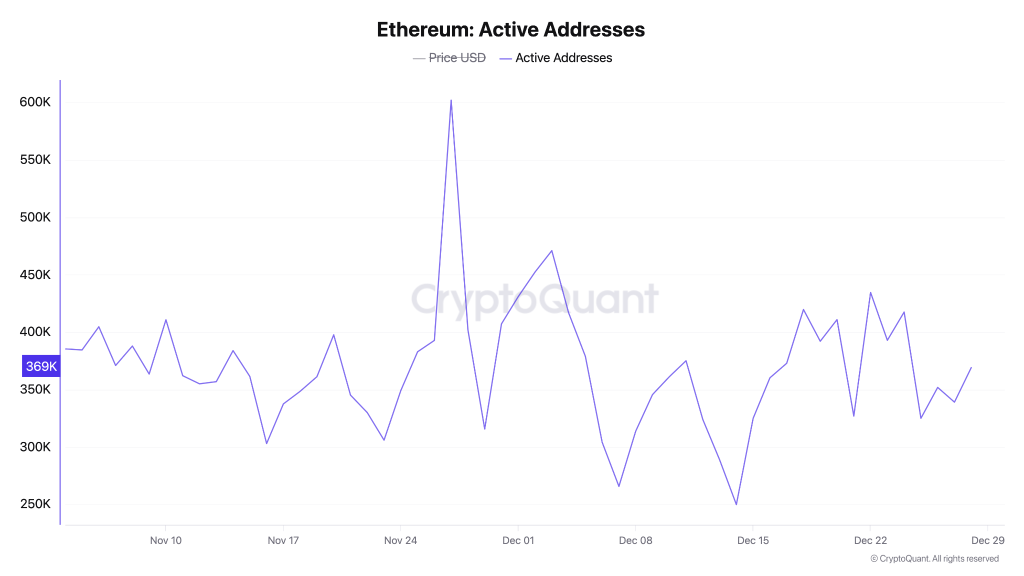

Network Activity: Active Addresses Remain Resilient

On-chain data shows Ethereum’s daily active addresses holding broadly within the 350,000 to 400,000 range, with periodic spikes higher. While activity has not accelerated sharply, it has also not broken down despite recent Ethereum price weakness. This stability suggests continued network usage and participation. This reinforces the view that the current market phase reflects consolidation rather than demand erosion.

Ethereum Price Analysis: Compression Near Key Levels

The Ethereum price is moving within a tight range, forming higher lows while repeatedly facing resistance near the $3,200–$3,300 zone. This creates a clear compression pattern, where price is getting squeezed between rising support and horizontal resistance. Volatility has dropped sharply, which usually signals that a bigger move is coming. The RSI is holding near neutral levels, showing neither strong bullish nor bearish momentum yet. Overall, the chart suggests ETH is building pressure for a breakout rather than showing signs of weakness.

Conclusion: Liquidity Is Building, Confirmation Is Still Needed

Ethereum is approaching a decisive zone where improving liquidity metrics must translate into price confirmation. On the upside, a sustained break and acceptance above the $3,200–$3,300 resistance zone would validate the rising open interest and tightening exchange supply. If this level flips into support, the ETH price could open room for a move toward $3,500 initially, followed by a broader upside extension toward the $3,800–$4,000 range in early 2026.

On the downside, failure to hold the rising trendline support near $2,900–$3,000 would weaken the bullish setup and risk a deeper pullback toward $2,600–$2,550, where stronger demand is expected to re-emerge. Until either level breaks decisively, Ethereum remains in consolidation—but the compression suggests a larger directional move is building.

FAQs

Liquidity can build quietly when traders hedge, roll positions, or prepare for events without committing to direction. Price often reacts only after a catalyst forces positions to unwind or expand.

Short-term derivatives traders face the highest risk, as leveraged positions can unwind quickly. Spot holders are less affected day to day but benefit or lose as volatility resets the market.

Extended consolidation increases the chance of a sudden volatility spike, as crowded positions become unstable. This can lead to rapid moves in either direction once liquidity shifts.